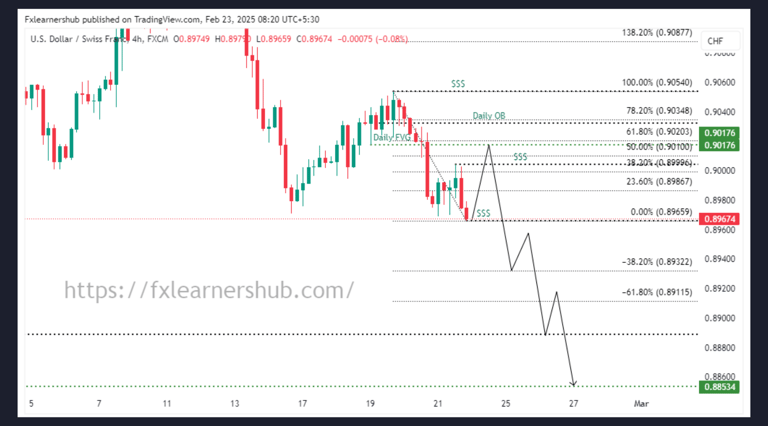

USDCHF Weekly Analysis 02/22/2025

Satheesh Gobi

2/23/2025

Fundamental analysis

1. Overview of Momentum and Market Structure

Current Momentum: Bearish

Previous Week’s Performance: Bearish

Range: 0.9054 – 0.8965

Expectations: Price is expected to decline towards liquidity zones before potential reversals.

Trading Plan

For Long Positions

Strategy:

Look for buy opportunities at strong demand levels:

Buy Levels:

0.8932 (Extension - Key Demand Zone & Institutional Buy Area)

0.8888 (Weekly FVG - Major Support & Potential Bounce Zone)

0.8853 (Daily FVG - Long-Term Demand Zone & Liquidity Pool)

Buy Targets:

0.8965 (First Upside Target & H4 FVG Rebalance Zone)

0.9004 (H4 Liquidity - Key Resistance & Potential Rejection Area)

0.9017 (Daily FVG - Sell Zone & Profit-Taking Area)

0.9032 (Daily OB - Strong Supply Zone & Market Structure Level)

Bearish Bias

Strategy:

Look for sell opportunities from key resistance and liquidity zones:

0.9004 (H4 Liquidity - Key Resistance & Potential Rejection Area)

0.9017 (Daily FVG - Strong Supply Zone & Sell Entry Point)

0.9032 (Daily OB - Institutional Sell Zone & Major Reversal Level)

Primary Targets:

0.8965 (Extreme Liquidity - Strong Demand Zone & First Downside Target)

0.8932 (Extension - Major Liquidity Grab & Potential Reversal Area)

0.8888 (Weekly FVG - High-Probability Demand Zone)

0.8853 (Daily FVG - Strong Support for Potential Bounce)

Summary

Bearish bias remains valid below 0.9032, targeting 0.8965, 0.8932, 0.8888, and 0.8853.

A clean break below 0.8965 (Extreme Liquidity) may accelerate selling pressure.

Long setups become valid near 0.8932, 0.8888, and 0.8853 for potential rebounds.

Monitor price action at FVGs and liquidity zones for confirmation.

Technical analysis

The USD/CHF pair faces downward pressure as risk aversion intensifies following US President Donald Trump’s renewed tariff threats, fueling concerns over a global trade war. Investors seek safety in the Swiss Franc (CHF), limiting USD gains despite hawkish FOMC minutes. Meanwhile, falling US Treasury yields weigh on the US Dollar Index (DXY), capping any upside momentum. However, expectations of a prolonged Fed rate pause could provide some support for the pair in the near term. Traders will closely monitor upcoming US economic data and geopolitical developments for further direction.