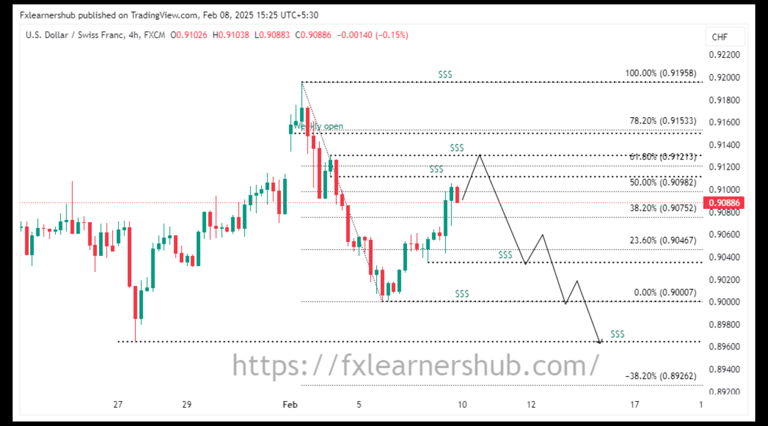

USDCHF Weekly Analysis 02/08/2025

Satheesh Gobi

2/8/2025

Fundamental analysis

1. Overview of Momentum and Market Structure

Current Momentum: Bearish.

Previous Week's Performance: Bearish.

Range: 0.9195 – 0.9000

Expectations: Anticipating a bearish continuation within the range, targeting new lows.

Trading Plan

Bearish Bias

Strategy:

Watch for price action rejections at the following resistance zones:0.9111 (H4 FVG)

0.9130 (H4 Liquidity)

0.9149 (Weekly open)

Targets:

Primary target: 0.9034 (Internal Liquidity) and 0.9000 (Extreme Liquidity).

Secondary target: 0.8964 (Daily Liquidity) and 0.8926 (Extension)

For Long

Strategy:

Monitor price action at the following support levels for potential reversals:0.9000(Extreme Liquidity)

0.8964 (Daily Liquidity)

0.8926 (Extension)

Confirmation:

Look for reversal patterns such as bullish engulfing candles or order block formations before entering long positions.Targets:

Primary Target: 0.9111 (H4 FVG) and 0.9130 (H4 liquidity).

Extended Target: 0.9149(Weekly Open) and 0.9195 (Extreme Liquidity).

Summary

The bias remains bearish within the 0.9195 – 0.9000 range.

Short entries are favorable around resistance levels (0.9111, 0.9130, 0.9149) with confirmation.

Long opportunities may arise near or below 0.9000/0.8964 if signs of exhaustion emerge.

Use your strict money management rules to manage risks effectively.

Technical analysis

The USDCF pair gains traction and marked a high above 0.9100 on Friday. The US added just 143K jobs in January, below the 170K forecast, while wage growth rose to 4.1%, complicating the Fed’s policy outlook.

Meanwhile, the Swiss Franc (CHF) gains support as risk sentiment remains fragile amid global trade tensions and cautious monetary policy from the Swiss National Bank (SNB). With uncertainty ahead, traders will watch upcoming US inflation data for further USD/CHF direction.