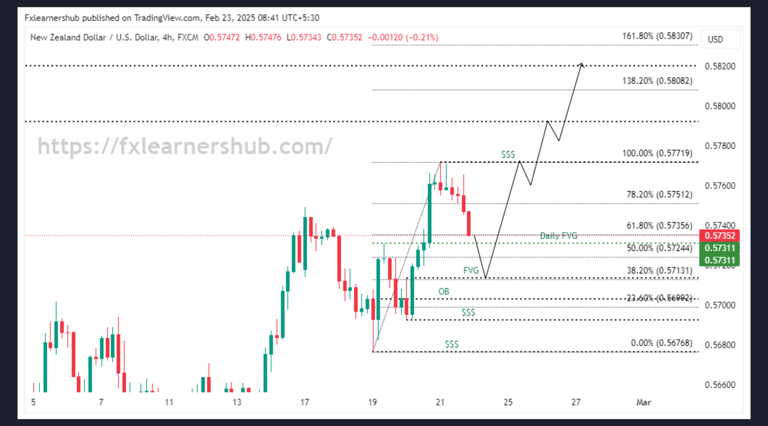

NZDUSD Weekly Analysis 02/22/2025

Satheesh Gobi

2/23/2025

Fundamental analysis

1. Overview of Momentum and Market Structure

Current Momentum: Bullish

Previous Week’s Performance: Bullish

Range: 0.5676 – 0.5771

Expectations: Price is expected to push higher towards liquidity and FVG zones before potential reversals.

Trading Plan

For Short Positions

Strategy:

Look for sell opportunities at strong resistance and liquidity zones:

Sell Levels:

0.5771 (Extreme Liquidity - Key Reversal Zone & First Sell Entry)

0.5792 (Daily Liquidity - High-Probability Sell Area)

0.5820 (Weekly FVG - Strong Supply Zone & Potential Market Rejection)

Sell Targets:

0.5731 (Daily FVG - Support & Rebalance Area)

0.5713 (H4 FVG - Demand Zone & Buy Entry Area)

0.5692 (H4 Liquidity - Strong Support for Potential Reversal)

Bullish Bias

Strategy:

Look for buy opportunities at strong demand and liquidity zones:

0.5731 (Daily FVG - Key Support & Institutional Buy Zone)

0.5713 (H4 FVG - Bullish Order Block & Potential Reversal Area)

0.5692 (H4 Liquidity - Liquidity Pool & Strong Demand Area)

Primary Targets:

0.5771 (Extreme Liquidity - First Upside Target & Key Resistance Zone)

0.5792 (Daily Liquidity - Major Liquidity Pool & Potential Rejection Level)

0.5820 (Weekly FVG - Extended Target & Institutional Sell Zone)

Summary

Bullish momentum remains valid above 0.5692, targeting 0.5771, 0.5792, and 0.5820.

A clean break above 0.5771 (Extreme Liquidity) may trigger further upside movement.

Short setups become valid near 0.5771, 0.5792, and 0.5820 for potential reversals.

Monitor price action at FVGs and liquidity zones for confirmation.

Technical analysis

The NZD/USD pair remains steady despite Reserve Bank of New Zealand (RBNZ) Chief Economist Paul Conway reaffirming the bank’s outlook for 75bps of easing over the next year. Conway noted that the weaker New Zealand Dollar (NZD) has supported exports and is expected to aid economic growth recovery by late 2024. Additionally, the country’s trade deficit has narrowed to a three-year low, signaling improving external balances. However, the prospect of further RBNZ rate cuts may limit NZD’s upside, keeping traders cautious amid broader market sentiment.