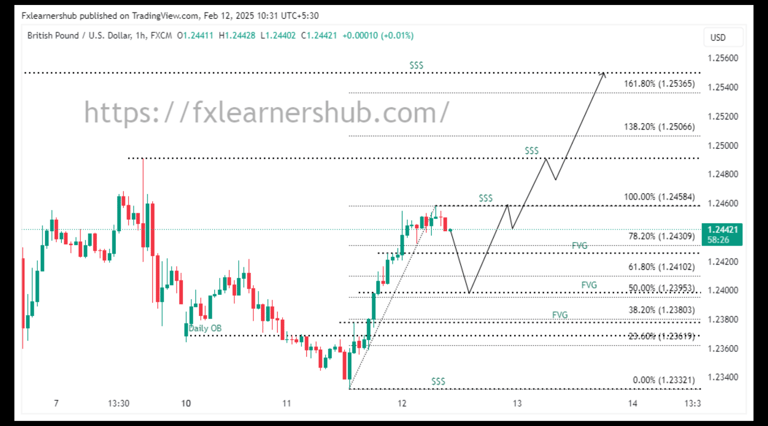

GBPUSD Intraday Analysis 02/12/2025

Satheesh Gobi

2/12/20252 min read

Technical analysis

1. Overview of Momentum and Market Structure

Current Momentum: Bullish.

Previous Day's Performance: Bullish.

Range: 1.2332 – 1.2458

Expectations: Anticipating a bullish continuation within the range, targeting higher liquidity levels.

Trading Plan

Bullish Bias

Strategy:

Watch for price reactions at the following support zones for potential long entries:

1.2425 (H4 FVG)

1.2398 (H4 FVG)

1.2377 (H4 FVG)

Targets:

Primary targets: 1.2458 (Extreme Liquidity).

Extended targets: 1.2491 (Daily Liquidity), 1.2549 (Daily Liquidity).

For Shorts

Strategy:

Monitor price action at the following resistance levels for potential reversals:

1.2491 (Daily Liquidity)

1.2549 (Daily Liquidity)

Confirmation:

Look for reversal patterns such as bearish engulfing candles or order block formations before entering short positions.

Targets:

Primary Target: 1.2425 (H4 FVG), 1.2398 (H4 FVG).

Extended Target: 1.2377 (H4 FVG), 1.2332 (Extreme Liquidity).

Summary

The bias remains bullish within the 1.2332 – 1.2458 range.

Long entries are favorable around 1.2425 – 1.2377, with confirmation from price action.

Short opportunities may arise near or above 1.2491 – 1.2549 if signs of exhaustion emerge.

Use your strict money management rules to manage risks effectively.